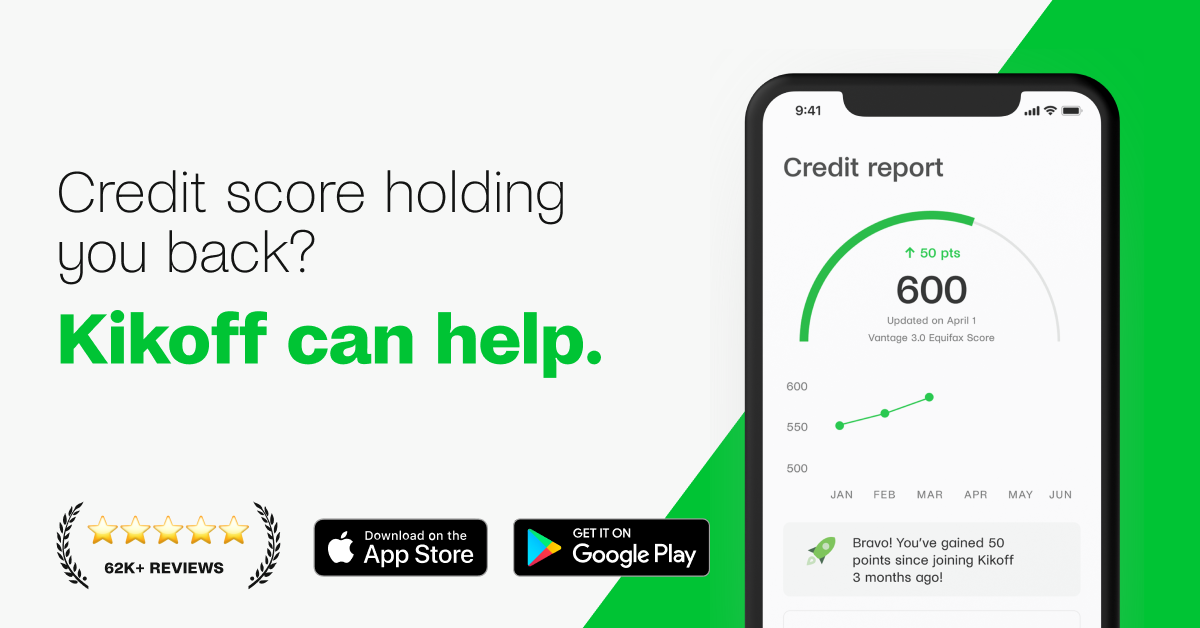

Kikoff is a financial technology company that aims to help individuals build credit and achieve financial health. Established with the mission to make credit accessible and beneficial for everyone, especially those new to credit or looking to rebuild their credit scores, Kikoff offers a unique approach to credit building. Here’s an overview of how Kikoff generally operates and its offerings, based on information available up to my last update in April 2023:

Kikoff Credit Account

- Credit Builder Loan: Kikoff’s primary product is a Credit Builder Loan designed to help users establish or improve their credit scores. Unlike traditional loans, the amount borrowed is held in a locked account rather than disbursed directly to the user. Customers make small monthly payments towards the loan, and Kikoff reports these payments to the major credit bureaus, which can help build credit history.

- Low Cost: The service is designed to be affordable, with a low monthly fee and no interest charges, making it accessible for individuals who are budget-conscious or have limited financial resources.

- No Credit Check: Kikoff typically does not require a credit check for new accounts, making it an attractive option for those with no credit history or low credit scores.

Financial Literacy

- Educational Resources: Kikoff also emphasizes financial education, offering resources to help users understand credit scores, credit reports, and general financial wellness. This educational component is crucial for individuals new to credit or those looking to make informed financial decisions.

How It Works

- Sign Up: Users sign up for Kikoff, usually through a simple online application process.

- Monthly Payments: Once approved, users make regular, small payments towards their Credit Builder Loan.

- Credit Reporting: Kikoff reports these payments to the credit bureaus, helping users build a positive credit history.

- Credit Score Improvement: Over time, this activity can improve the user’s credit score, provided they make payments on time and manage other credit accounts responsibly.

Considerations

While Kikoff can be a valuable tool for building or improving credit, it’s important for potential users to consider their overall credit strategy. This includes managing existing debts, keeping credit card balances low, and making all payments on time. Kikoff should be part of a broader financial plan for best results.

Conclusion

Kikoff offers a novel approach to credit building, especially suited for those starting their credit journey or looking to improve their scores. By combining low-cost credit building products with educational resources, Kikoff aims to empower individuals to achieve financial health. As with any financial product, potential users should carefully review the terms and consider how it fits into their broader financial strategy. Visit Kikoff