Lenme is a digital platform that facilitates peer-to-peer (P2P) lending and borrowing, connecting borrowers directly with investors without the need for traditional financial intermediaries. This platform offers a range of features designed to streamline the lending process, reduce costs, and provide flexible financing options for both parties.

For borrowers, Lenme provides a straightforward way to request loans ranging from small amounts up to $5,000. It’s designed to offer quick access to funds with the potential for competitive interest rates, catering to users regardless of their credit score. The process is touted as being efficient, with the possibility of getting loan approvals within just a few clicks.

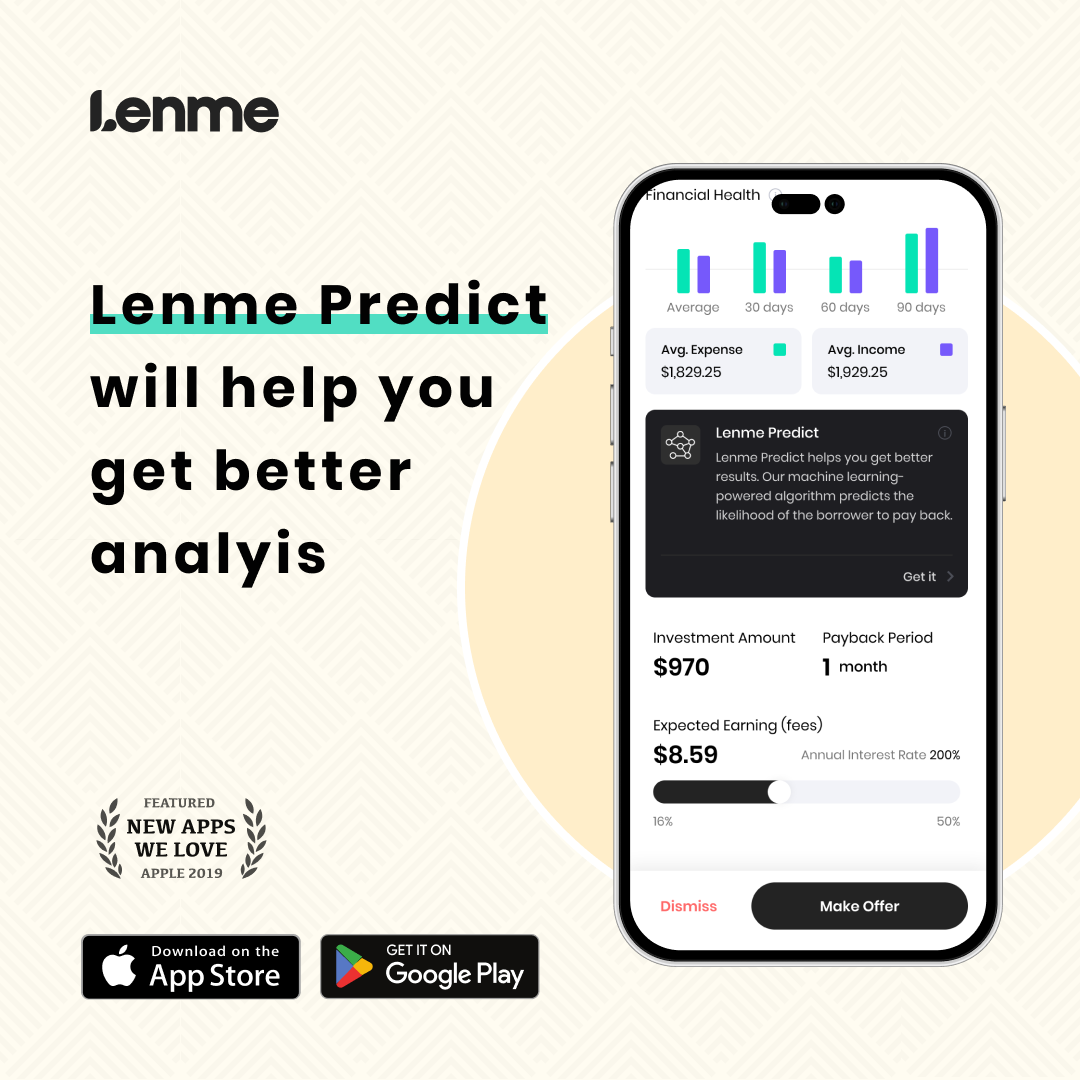

Investors on Lenme can benefit from the platform by directly lending their money to borrowers, potentially earning returns on their investment. The platform employs machine learning algorithms and facial recognition technology for identity and creditworthiness verification, aiming to mitigate risk and ensure the credibility of borrowers.

Lenme also offers a subscription model for enhanced features, including LenmePredict, a machine learning algorithm that helps lenders assess risk more accurately. Subscriptions are available through Apple Pay for either monthly or annual periods, providing tools and insights to make informed lending decisions.

Moreover, Lenme emphasizes the use of technology to cut down on operational costs associated with traditional lending, passing on these savings in the form of lower fees and potentially higher returns for lenders and more accessible loans for borrowers.

Get a peer 2 peer loan or lend money